We’ve all heard about cryptocurrencies like blockchain or Bitcoin. What’s less well known is how this market works, why people invest in it, how they earn money, and what mistakes can lead to instant ruin. Our three posts on blockchain and cryptocurrencies, NFTs, and the metaverse cover the crypto basics. Today, we take a dive into a topic made hot by Donald Trump’s victory in the U.S. presidential election: alternative cryptocurrencies such as meme coins.

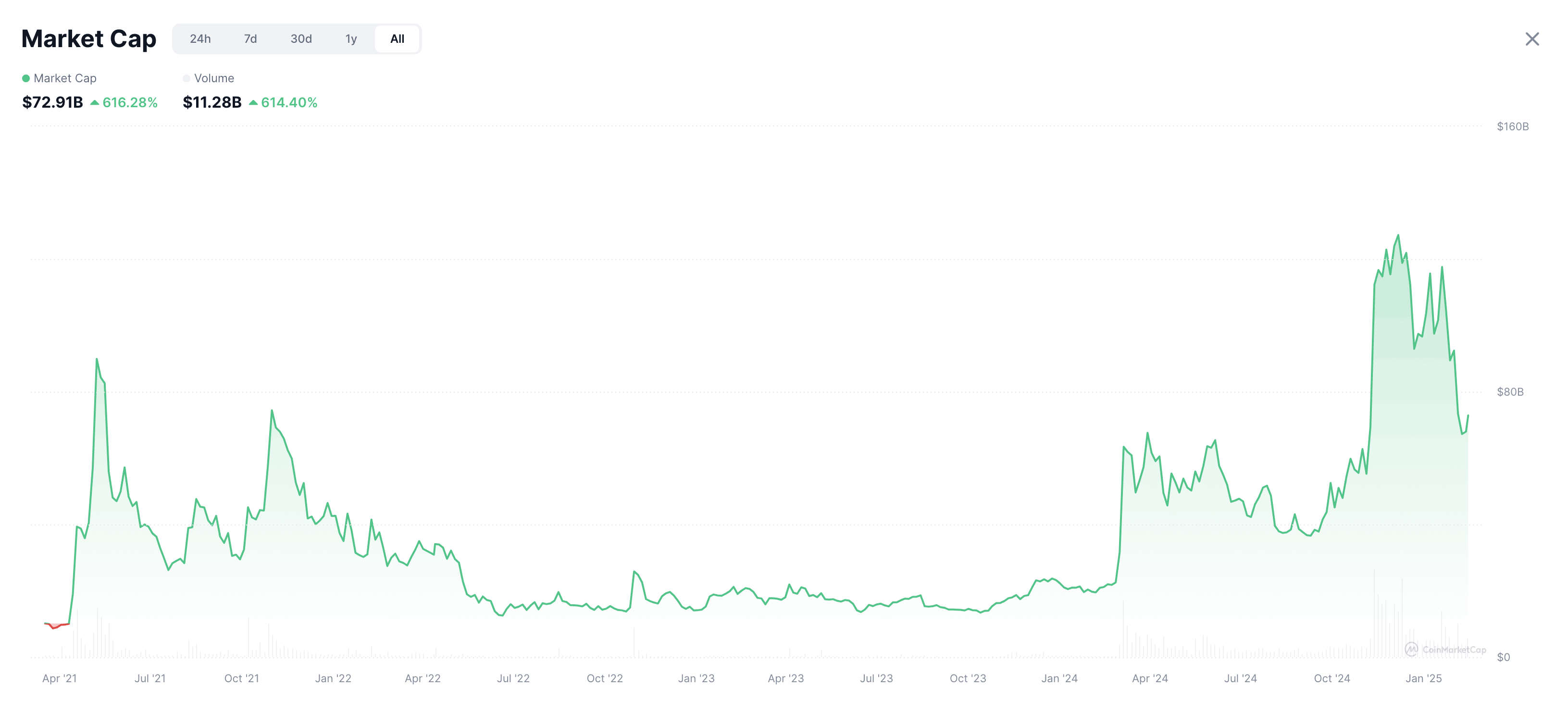

For those with little time to spare, here’s the TL;DR: Since 2021, the market capitalization of meme coins has fluctuated wildly between $8 billion and $103 billion, with towering ups and crashing downs. The chances of losing money greatly outweigh those of making it, and the number of scams is high even by crypto market standards. So the moral is: don’t invest money that you can’t afford to lose — even into something that bears the name of the current U.S. President.

For those with a little more time on their hands, let’s take a look at some joke cryptocurrencies, explore what — if anything — they have in common with NFTs, and tell you what precautions to take if you’re determined to invest in this high-risk market.

Check out how meme-coin market capitalization has changed over the past few years. Source

Meme coins and altcoins — what are they?

Technically, meme coins (aka meme tokens, meme cryptocurrencies) are a type of altcoin; that is — alternative cryptocurrencies. “Alternative” purely in the sense of not being the largest and most widespread of cryptoassets: Bitcoin and Ethereum. Historically, altcoins tended to be launched as independent blockchain platforms, but today they’re more likely to piggyback an existing popular blockchain platform, such as Solana.

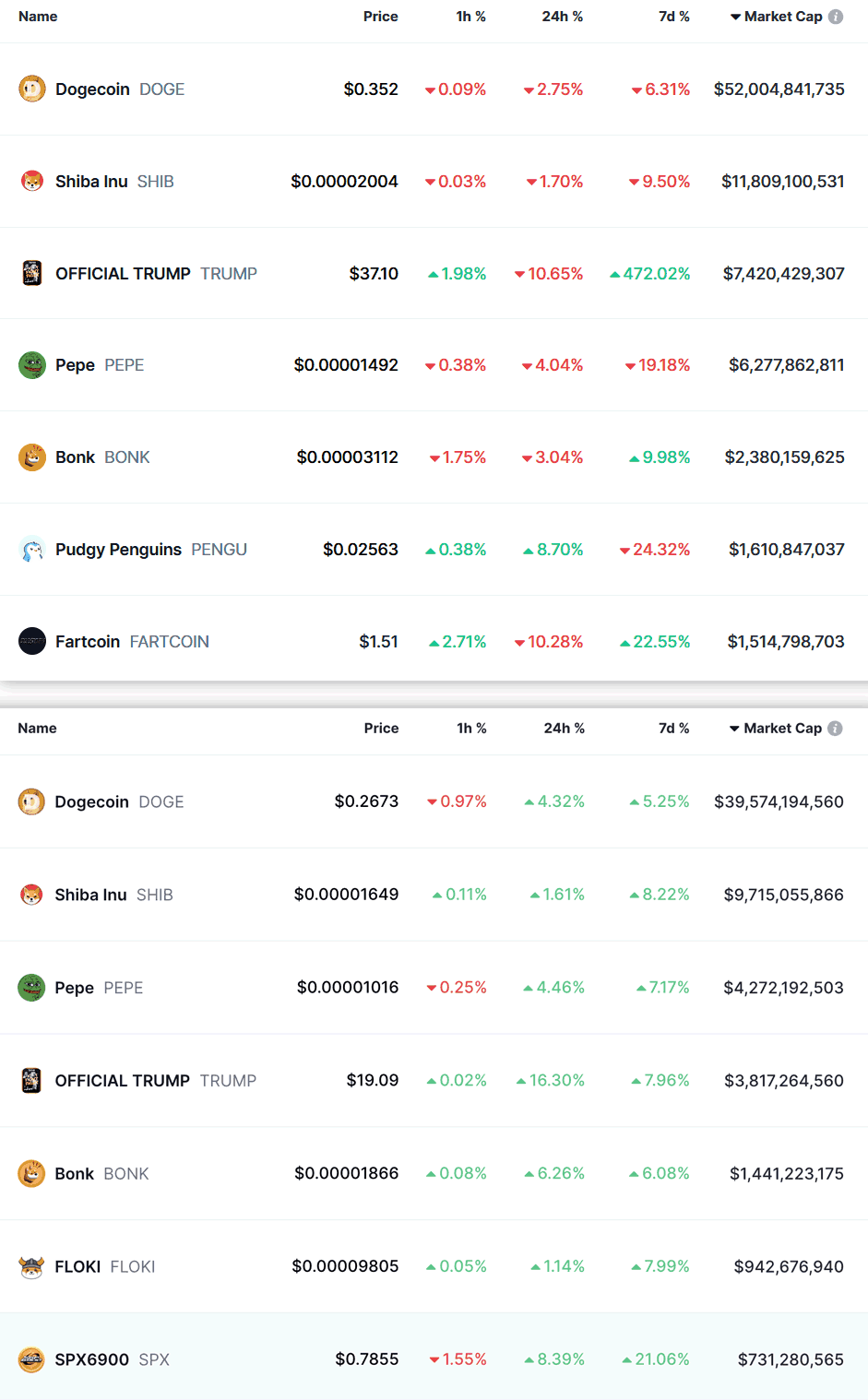

To get a sense of the volatility of the meme coin market, compare the price and capitalization of certain randomly-chosen tokens in three weeks from late January (top) to mid-February (bottom), 2025. Source

In their issuance and circulation mechanisms, most altcoins offer holders some tangible benefits — from low fees and high transaction speeds to pegging to real-world assets. However, meme coins, of which Dogecoin was the first, were initially issued as a joke, and a chance to invest in a fleeting social trend — to show one’s love for a meme, or support for an actor, public figure, or media personality. Although a meme coin is a cryptocurrency, its value is determined primarily by how enthusiastic people are to invest in it. As a result, these crypto assets are prone to sharp price spikes, depending on who wrote what on social media, whether people liked an actor’s new movie, and other such factors.

Meme coins and NFTs — similarities and differences

Both meme coins and NFTs use blockchain technology to store ownership info and transaction history. But unlike cryptocurrencies — where any two coins are equivalent and interchangeable, just like a couple of hundred-dollar bills, each individual NFT is unique, and hence the name: non-fungible tokens. Each token secures ownership of some unique digital asset — imparting collector value to NFTs.

And because collector value is largely subjective, NFTs, like meme coins, are highly susceptible to hype, speculation, and wild price swings.

Top meme coins

This section will age fast, but at the time of posting, the biggest meme coins by market capitalization are Dogecoin (ticker symbol: DOGE), Shiba Inu (SHIB), Pepe (PEPE), OFFICIAL TRUMP (TRUMP), and Bonk (BONK) — with the first exceeding $39 billion, and the last just below $1.5 billion. The TRUMP meme coin was nowhere in the vicinity of this top list a month ago — further proof of just how fickle this market is.

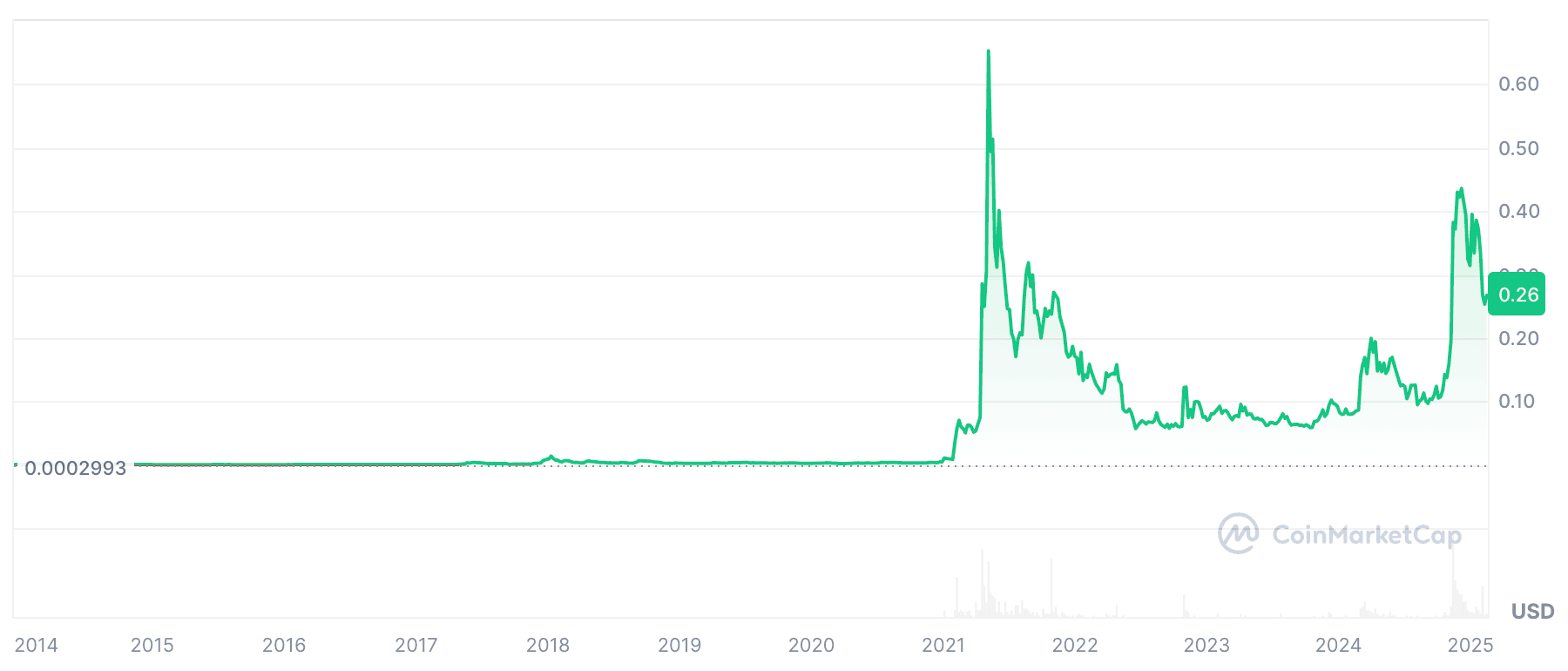

The pack leader, Dogecoin, however, is a real survivor. More than a decade old, its value hovered between $0.0001 and $0.0002 for the first two years, and rarely nudged past $0.01 in the following four. However, after being endorsed by Elon Musk in 2021, it briefly soared to $0.63, before sinking to around $0.06. It spiked again last November to over $0.4 after the presidential victory of the crypto-supporting Trump — over whom Musk appears to have some influence.

Price dynamics of the oldest meme coin, Dogecoin (DOGE). Source

TRUMP, MELANIA, and BARRON

The new U.S. President’s family deserves a separate chapter in our story because it perfectly illustrates the essential properties of meme coins.

Just three days before taking office in 2025, Trump announced the launch of his eponymous meme coin, which climbed to $75 in just two days, then halved, and has been steadily falling over the past three weeks — dropping to around $19 at the time of posting. Technically, TRUMP is issued on the Solana blockchain, with a total “mintage” of one billion coins. However, only 200 million were released into circulation, while the rest remained under the control of CIC Digital LLC and Fight Fight Fight LLC — both affiliated with the Trump Organization.

Price dynamics of the OFFICIAL TRUMP meme coin (TRUMP). Source

With the issue structured in this way, the Trump Organization can dictate both prices and demand, since it controls significantly more coins than are on the open market. It can make money by selling coins at high prices — both saturating the market and driving prices down. Or it can choose not to sell, and instead wait for an uptick in market sentiment to maximize profits. Value dilution due to increased supply primarily hits those who bought the coins at peak value and hype — favoring both buyers who got the coins cheaply, and those who issued the coin in question.

This approach has drawn criticism from many in the crypto industry, such as Nick Tomaino: “Trump owning 80% and timing launch hours before inauguration is predatory and many will likely get hurt by it”.

Blockchain analysis firm Chainalysis showed that in the first few days after the launch, almost 80% of the 600,000 buyers earned less than $100 on the token, and barely recouped their investment. Tellingly, 50% of TRUMP buyers were crypto first-timers who had only created a wallet and plunged into the market specifically for this deal.

A few weeks later, almost all TRUMP investors were out of pocket. At the same time, a select group of 21 “whales” (buyers of 500,000+ tokens) made over $214 million in the first days of the meme coin’s circulation.

In all fairness, the website distributing the coins does state that buying them represents “an expression of support for, and engagement with, the ideals and beliefs embodied by the symbol $TRUMP”, and is not to be seen as an investment.

Two days after the TRUMP announcement, the First Lady followed suit with the launch of her own meme coin. Having briefly risen above $12, just a day later MELANIA took a downward turn and spent a couple of days at the $3-5 range, before stabilizing at around $1.4. Just as the MELANIA launch news broke, TRUMP plummeted.

Naturally, all this hullabaloo over “political” meme coins could hardly escape the attention of scammers. Blockchain platforms witnessed a mushrooming of tokens with TRUMP as the ticker symbol or in the description — despite having nothing to do with the “official” meme coin.

The most eye-catching was the meme coin in the name of the U.S. president’s youngest son, Barron Trump. Aided by a profile on the Pump.fun website (where anyone can quickly launch their own meme coin) plus a handful of X posts pretending to be related to an investigation and leaked insider information, in just a few hours the unofficial meme token scored a market capitalization of $460 million. However, when proof of “presidential” origin failed to materialize, the token crashed by 95%.

Major meme coin and NFT scams

Rug pull (exit scam).

The most common scam associated with newly-issued crypto assets. Scammers mislead buyers about the origins of a particular coin or NFT project and the value of the tokens, sell a bunch of them, and vanish. The purchased tokens remain with the new owners but rapidly depreciate. In the case of meme coins, this scheme is often implemented with a celebrity allegedly issuing their own token, which later turns out to be a hoax. In the case of NFTs, buyers are promised non-existent privileges or collector value. An infamous case was the Baller Ape Club NFT, which led to one of the first indictments for NFT fraud. According to Chainalysis, almost one in 20 tokens issued in 2024 may have been rug pulls; while in 2021, these scams brought crypto investors a total loss of $2.8 billion.

“Namesake” attack. For easy identification on crypto exchanges and other crypto platforms, each token is assigned a unique code known as a ticker — just like on traditional exchanges: BTC, USDT, TRUMP, and so on. But in reality, the buying and selling of tokens is based not on tickers, but on long, hard-to-read smart contract addresses. A common attack exploits this duality. Scammers create their own tokens (altcoins) with a different contract address in the blockchain — but under the same ticker as a popular token, for example, TRUMP. Sometimes the scheme might even work when the ticker is different, and the big-draw name simply appears in the coin description. Such tokens are often launched on a different blockchain where the original coin isn’t traded. All these scenarios boil down to the same thing: the victim buys a totally different crypto asset, which likely has no value.

The website selling genuine TRUMP tokens states the associated smart contract address explicitly. However, scammers can create a copy of the website and post a different smart contract address

Honeypot tokens. These are tokens whose smart contract doesn’t allow their sale. In other words, you can invest money in them, but not withdraw it. This scam is often combined with the “namesake” attack.

Drainers. Our separate post covers this threat in detail. Thinking they’re buying meme coins or NFTs, victims enter their credentials on a fake website and have their crypto wallets emptied. The bait website either mimics the official one, or offers a fake promotion such as a token airdrop.

Phishing and malware. Under the guise of social media posts by celebrities, messages from technical support, and countless other pretexts, attackers swindle private keys and seed phrases from crypto holders, as well as install malware on their computers and phones to siphon off crypto-related information. The outcome is always the same: the loss of all funds in the crypto wallet.

There are other, more exotic ways of stealing cryptocurrency: hacking old Bitcoin wallets through encryption algorithm bugs, fake hardware crypto wallets, and infected games like Mario Forever or tanks.

There are even Robin Hood scams targeting crypto thieves themselves. A juicy bait is dangled before their eyes — for example, “leaked” credentials of wallets supposedly containing hundreds of thousands of dollars or seed phrases for real crypto wallets — but after paying a “fee” to withdraw the funds, they discover that a withdrawal isn’t possible.

Our blog is home to dozens of other gripping detective stories about crypto scams. Sadly, the list is expanding daily, so subscribe now to keep up to date with all the latest threats.

How not to lose money on crypto, NFTs, and meme coins

- Don’t invest in crypto assets if you have any doubts about your financial situation or the stability of global markets, or don’t feel sufficiently qualified.

- Don’t invest in crypto assets (or anything else) what you can’t afford to lose.

- If you need crypto assets for payment purposes, use coins with low volatility, such as USDT stablecoins, and don’t buy more crypto than you need to settle the account.

- If you’re investing in crypto assets for profit, be prepared to closely monitor the market dynamics and react quickly. This is a daily job, all the more so for meme coins — you need to track social media trends and strike when the market is hot. Cryptocurrency speculation (on meme coins in particular) is very strong in Asia, so you may have to adjust your “trading day” to the Far Eastern time zone.

- Give preference to projects and tokens that have been on the market for a while and earned a certain reputation.

- If buying a newly launched token, make sure it isn’t a rug pull or Ponzi scheme. This will require researching the reputation of the project creators and the token’s technical features. If the project’s smart contracts have been audited, study the results. The lack of such an audit isn’t a red flag per se, but it should put you on your guard. If it’s a meme coin linked to a celebrity, look at their official social media accounts and profiles, and make sure they were actually involved.

- Buy tokens on large platforms that have internal standards and comply with legal regulations. Examples include Binance and Coinbase. When getting information about a token, especially its smart contract address, make sure you visit the official site and not a fake. Don’t enter crypto wallet credentials, card details, or other sensitive information on third-party sites.

- Carefully check smart contract and crypto wallet addresses to avoid buying a “namesake”.

- Be careful when searching for crypto-related sites, news, and social media accounts, and be wary of messages sent to you in email and messaging apps. Crypto investors are frequent targets of phishing and pig butchering

- Install comprehensive security solutions on all your devices to protect against malware and websites designed to steal crypto assets. We recommend Kaspersky Premium, which offers additional privacy protection and data-leak monitoring tools, plus the built-in online payment protection system Safe Money.

The information in this article is for informational purposes only and does not constitute investment advice. The instruments discussed may not match your investment profile, financial situation, investment experience, or investment goals.

cryptocurrencies

cryptocurrencies

Tips

Tips